31 January 2025

How to Choose the Best Mobile App Development Company for Your Business Read More - Premium App & Web Development With Limited-Time Savings  Enjoy 20% Off All App & Web Services

Enjoy 20% Off All App & Web Services  Claim Your Offer Today -

Claim Your Offer Today -

Recall the time when banking applications were merely digital checkbooks? The era of basic balance inquiries and bill settlements is over—modern AI in banking applications not only monitors your finances; they also make decisions on your behalf.

Imagine getting a tailored savings suggestion just before making a big purchase, or being alerted to potential fraud before you even become aware of an issue. This is not a distant vision of banking; it is already a reality, and it is advancing more rapidly than many people understand.

Behind each swipe, tap, and transaction, artificial intelligence is quietly transforming finance, converting your smartphone into a round-the-clock financial advisor, fraud investigator, and savings mentor—all in one.

Banking apps used to be just digital ledgers that let you check your balance, pay bills or maybe even send money. Today, they are smart financial helpers that use artificial intelligence to work behind the scenes. Mobile banking apps with AI are changing the way people bank, and it’s doing it faster than most people know. For example, it can send you a personalised savings tip or alert you to a suspicious transaction before you even notice it.

Business Insider says that almost 80% of banks think AI is important for their future success. The global AI in fintech market is expected to be worth more than $40 billion by 2030. It’s clear that AI is no longer a new trend. It’s the new base for new ideas in banking and finance.

But what exactly is AI doing to make this change happen? And what does this mean for developers, fintech companies, and banks that want to make apps for the next generation?

In this blog post, we talk about the most important AI use cases in banking, features, and backend strategies that are shaping AI in the development of banking apps. This guide will help you understand how to use AI to not only keep up, but also to lead, whether you are a product leader, engineer, or decision-maker.

However, in what specific ways is artificial intelligence in banking apps changing from being merely passive tools to becoming active financial allies? Let us explore this further.

Artificial Intelligence is redefining mobile banking by transforming how users manage, secure, and grow their finances. From real-time fraud detection and personalized financial recommendations to 24/7 intelligent customer support, AI significantly enhances both convenience and trust.

By analyzing market trends, customer behavior, transaction patterns, and digital interactions, AI enables banks to deliver human-like engagement at scale across retail, commercial, and investment banking. It also improves risk assessment, accelerates decision-making, automates compliance checks, and helps banks proactively anticipate customer needs—making banking smarter, faster, and more customer-centric than ever before.

AI isn’t just a trendy word; it’s the driving force behind innovation in FinTech. Banks and other financial institutions all over the world are using AI to stay ahead in a world that has almost gone digital overnight.

A report from PwC says that almost 52% of financial services companies are already spending a lot of money on AI. And it’s not just the big names; everyone is getting in on the action, from digital-first neobanks to smaller regional banks. This shows how much AI is changing the way money works.

So what is causing this huge change? First of all, what customers expect is changing. People don’t just “use” AI in mobile banking apps anymore; they live through them. They want a mobile experience that is always available, has smart insights, personalised recommendations, and rock-solid security.

With the growing pressure to come up with new ideas quickly and meet stricter rules, AI becomes more than just a nice-to-have. It’s a must for strategy.

There is a huge difference between regular banking apps and those that use AI in mobile banking apps. Older apps often only showed you a list of transactions, an updated balance, and maybe a simple support chatbot if you were lucky.

Right now? AI is changing the way apps work so that they feel more like smart assistants than tools.

Artificial intelligence in banking apps can not only answer a user’s question, but also guess what they need. They can find fraud in real time, learn about your spending habits, and send you very personalized reminders to save, invest, or plan ahead. They can make lending easier, customize offers based on credit profiles, and even change interfaces based on how users interact with them.

This level of smart responsiveness raises the bar for user experience, and traditional systems can’t compete.

But this change isn’t just about cool new features. It’s also about getting people to trust you more. When a banking app can spot suspicious activity right away or give users timely information to help them make better financial choices, it changes the whole relationship between banks and customers.

AI is not only helping banks keep up with digital expectations, but it is also pushing them to change how banking feels.

But how exactly does AI turn these possibilities into tangible advantages? Let us analyze the core benefits that are currently redefining banking applications:

AI is no longer just a nice-to-have in banking apps, it is now at the core of creating smart, user-friendly, and future-ready mobile banking experiences. There are many benefits of AI in banking, from making things safer to giving you information about what might happen in the future. Platforms like Dev Story are enabling banks to integrate AI faster, creating smarter, more secure, and user-friendly mobile banking experiences.

This is one of the best benefits of AI in banking apps. Security has always been a top priority for financial institutions, and AI is redefining what “secure” really means.

Together, these tools allow AI to act as a proactive line of defence, not just a reactive one.

Today’s users expect more than just balance checks and transaction histories. They want artificial intelligence in banking apps that help them manage their financial future.

This level of personalisation not only builds trust but also increases daily app engagement, making it one of the best benefits of AI in banking apps.

Round-the-clock support has become the norm, and AI makes it scalable — without compromising on quality.

Chatbots don’t just reduce support costs, they also improve customer satisfaction by offering frictionless service.

AI brings powerful automation to the backend, which translates to faster services for the user and lower operational costs for the bank.

This shift not only accelerates service delivery but frees up human teams to focus on more strategic tasks.

Traditional credit scores often miss the full picture. AI applications in banking fills the gaps by bringing in more data, and fewer biases.

Regulatory compliance and risk management are complex, constantly evolving responsibilities for banks. AI simplifies both by making them predictive rather than reactive.

By embedding intelligence into compliance workflows, banks can reduce regulatory exposure, avoid penalties, and maintain trust—while scaling operations efficiently.

AI enhances banking apps beyond functionality by creating intuitive, adaptive user experiences that feel genuinely human.

AI-driven interfaces adjust layouts, notifications, and feature visibility based on user behavior and preferences.

With AI, credit scoring becomes more inclusive, efficient, and accurate, opening up financial access to more users.

Millions of customers now use mobile banking as their main way to do business, so banks are under pressure to make their apps smarter, faster, and easier to use. That’s where AI for banking comes in. It changes the way people deal with their banks. AI is working behind the scenes to make everything easier and smarter, whether you’re checking your balance, applying for a loan, or getting investment advice.

Let’s look more closely at some of the important AI features and uses of AI in banking apps that are making mobile banking more personalised, safe, and useful.

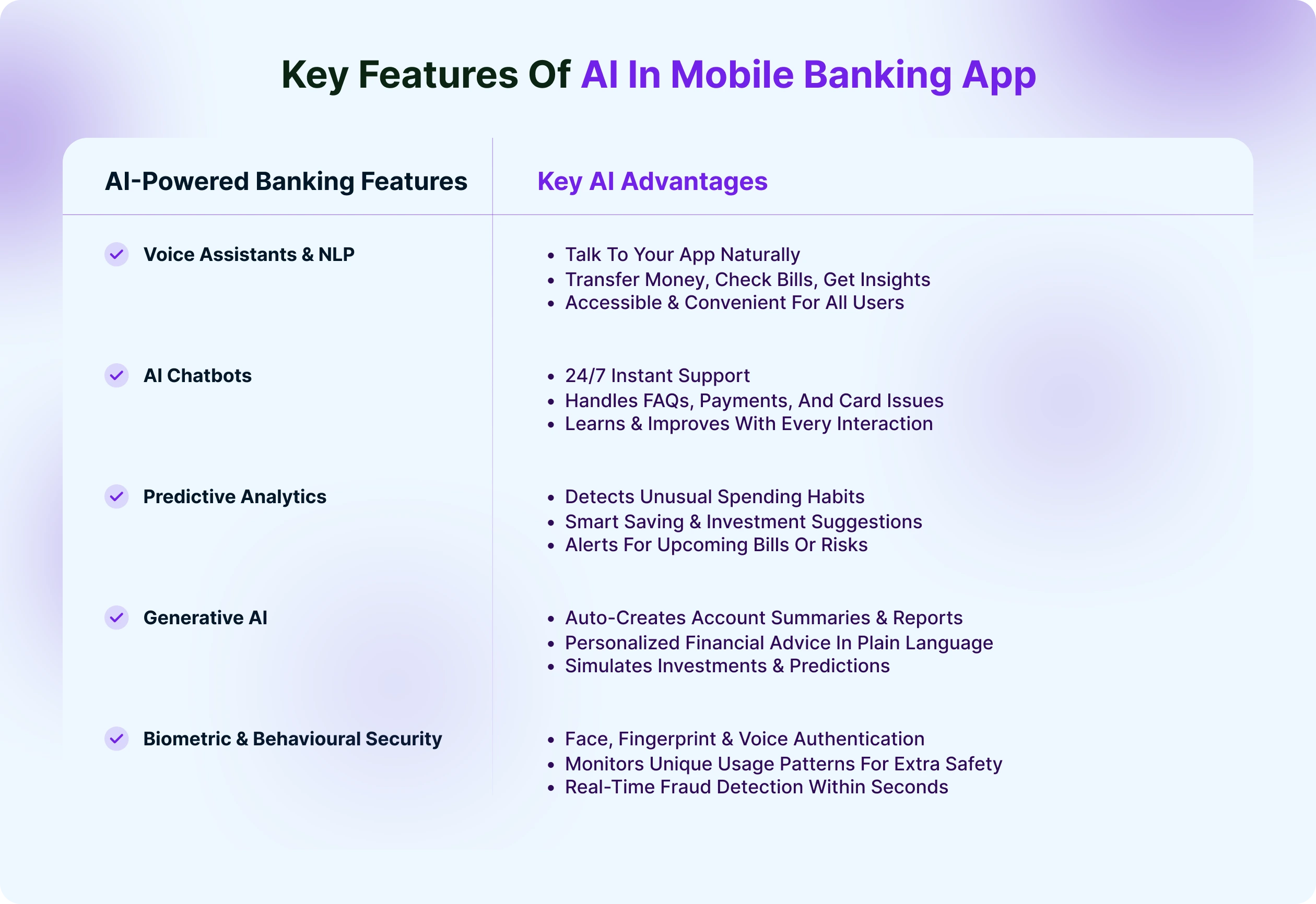

Typing is old news. These days, more users are starting to talk to their banking apps, and expecting intelligent answers. That’s thanks to Natural Language Processing (NLP), which powers voice assistants in mobile banking apps.

Voice assistants don’t just make it easier to get to things; they also make banking more open to everyone. Voice-first features make banking easier and more natural for older people, people with vision problems, and people who are always on the go.

And since NLP is always getting better, these assistants are becoming more like people, they can understand complicated requests and even give you helpful hints. It could be as easy as having a conversation to use mobile banking in the future.

No longer waits to talk to a customer service person. AI-powered chatbots now answer a lot of customer questions, and they don’t even play hold music.

These bots are available 24/7 and can:

Erica, the AI assistant from Bank of America, is one of the most famous examples. Erica can do a lot of things, like set up payments and give you financial advice, all through a simple, easy-to-use interface.

These chatbots are so useful because they get better with time. The more people use them, the better they get at giving useful and correct answers. And if they’re not sure about something, they send it up to a human without making the user repeat themselves.

This is when AI applications in banking start to seem a little like magic. There is a system behind every tap and transaction that looks for patterns, flags unusual activity, and finds ways to help users better manage their money.

AI can:

This isn’t just about reacting; it’s about proactive banking. “Looks like you’ve spent more on eating out this month, would you like to set a limit for next month?” Imagine opening your app and seeing this.”These smart nudges not only make life easier, but they also help you learn to be more financially responsible without making it feel like work.

This means that banks will be able to connect with their customers better. It’s like having a digital financial advisor who knows your habits and never sleeps. One of the best uses of AI in banking apps.

AI used to mostly help banks understand data. But now that banks use generative AI, they can make content and communication materials that are unique to each customer.

So what does this look like in a mobile app?

This level of personalisation makes people trust you more and makes the user experience better. It also saves banks a lot of time making content by hand.

Generative AI can also help advisors and clients simulate investment portfolios, make predictions, and make comparison charts, all within the app.

Trust and safety are everything when it comes to money. AI is very important for keeping banking apps safe. It does this by not only locking them down, but also making sure that only the right person can get in.

Today’s apps use biometric authentication like:

But AI for banking doesn’t stop there. It goes a step further with behavioural biometrics. That means the app keeps track of how you usually use it, like how fast you type, how you hold your phone, and how you swipe or tap. The app can raise a red flag or ask for more proof if something seems off, like someone else trying to copy you.

This type of authentication is always on and doesn’t bother the user, so it adds extra security. You don’t even know it’s working, but it is, and that’s a good thing.

And AI helps banks find fraud in less than a second. Real-time detection of suspicious transactions, login attempts from strange places, or changes in user behaviour lowers the risk of losing money.

There is a complicated network of backend systems, data flows, and compliance layers behind every smooth AI-powered feature on a banking app. AI in banking applications can make experiences for end users more intuitive, personalised, and efficient, but it also puts a lot of stress on the backend infrastructure. Financial institutions need to set up the right infrastructure for AI to work, both in terms of functionality, security and ethics. Remember mobile app security is one of the important factors for businesses to be considered while developing an app. This includes everything from choosing the right architecture to making sure they follow the rules.

Before banks and fintech companies can use AI-powered features, they need to think about some important backend issues.

First of all, the traditional monolithic architecture doesn’t work when you want to add smart features like voice-based transactions or predictive insights. You need something that can change quickly and grow easily, something that can do both.

Microservices and modular design come into play. Banks often work with AI technologies that change quickly and need to be updated often. With a modular structure, you can make changes to one part of the system without affecting the others. You can use and scale AI modules, like a chatbot engine, a fraud detection model, or a recommendation engine, on their own.

Here’s what an AI-ready backend typically involves:

By adopting such architecture, and application scalability methods to scale for long term success, banks are not just setting themselves up for AI success, but they’re also future-proofing their digital ecosystem.

AI needs data to work, but not just any data. You need datasets that are clean, well-labeled, and, in many cases, anonymous in order to get useful results. Sadly, many banks are still dealing with fragmented data environments, where customer data is stored in separate systems.

Here’s what needs to be done on the backend:

In short, managing data isn’t just about gathering it—it’s about making it usable and compliant.

Building a smart AI role in banking model is only the beginning. Banks need systems in place to continuously train, test, and monitor the performance of these models.

Here’s what this involves:

Without proper monitoring, even the most advanced model can turn into a liability.

Artificial intelligence (AI) doesn’t work in isolation in finance. Regulatory scrutiny must pass every new idea. There is more and more pressure to make sure that AI acts ethically, openly, and safely, from India’s RBI guidelines to the EU’s AI Act.

Here are some important things to think about on the backend for compliance:

Also, many countries are introducing mandatory AI governance frameworks. That means your backend should support functions like:

Partners like Dev Story ensure that your backend systems are aligned with legal standards. Banks can avoid reputational damage and build user trust, something that’s non-negotiable in financial services.

Implementing AI in banking isn’t just about having access to great algorithms or huge volumes of data, it’s about having the right strategy, structure, and processes to turn AI role in banking ideas into working, compliant, and scalable products. Whether you’re launching a smart virtual assistant or using predictive models to detect fraud, success hinges on getting the implementation journey right.

Let’s walk through the key elements that can help banks move from ambition to action when it comes to AI adoption.

Centralised vs Decentralised AI Teams

One of the first decisions banks need to make is how to structure their AI teams. There’s no universal blueprint here, different models work for different organisations depending on scale, priorities, and existing tech maturity.

In a centralized model, all AI/ML efforts are coordinated by a core team that supports various departments. This can lead to:

But the drawback? It can feel a bit too top-down. Innovation might slow down in individual business units.

In this model, each business function or product team has its own AI talent, think of it like having mini AI teams for retail banking, credit scoring, fraud detection, and so on. The pros:

However, without coordination, you risk duplicating efforts or using inconsistent models across the organisation.

This is what many mature banks eventually adopt, a central AI Centre of Excellence (CoE) that sets the guardrails, with embedded AI talent across functions. The CoE ensures best practices, compliance, and knowledge sharing, while local teams execute with agility.

When starting out or scaling quickly, many banks face this dilemma.

The general rule is to outsource in order to validate ideas quickly, and to build in-house when the solution becomes core to your business

AI Development Lifecycle

Introducing AI into banking workflows is not a plug-and-play process. It follows a structured lifecycle, and understanding this flow ensures teams don’t jump in unprepared.

This is where it all starts. Product and business teams identify potential AI use cases in banking, e.g., can AI reduce loan approval times? Can it personalise investment recommendations?

It’s important to evaluate:

A small-scale prototype is built to test if the AI model delivers results in a controlled environment. At this stage:

If the PoC is successful, the AI solution is tested in a real-world setting—often with a limited user base. This is where teams evaluate:

Once validated, the model is deployed at scale across the bank. At this point, you need:

Cross-Functional Collaboration

AI in banking isn’t just a data science project. It’s a cross-functional mission, and collaboration is the key to delivering value.

They handle the technical heavy lifting, model design, training, testing, and deployment. But without context, even the best models can miss the mark.

These teams define what problems need solving. They provide input on user pain points, process bottlenecks, and desired outcomes.

For example, if the product team is trying to improve credit card onboarding, they might work with data scientists to build a model that flags high-risk applicants early.

Especially in banking, regulations shape how AI can be used. Legal teams ensure:

Bringing it legal in early ensures that AI models don’t get blocked late in the process.

As AI transitions from experiments to production, IT ensures:

The C-suite sets the tone. Their buy-in ensures:

Aligning AI Outcomes with Business Goals

Too often, AI projects fail not because the tech doesn’t work, but because the business value isn’t clear.

To avoid this:

Real-World Use Cases of AI in Banking Apps

AI is no longer a future vision for banking, it’s already here, built into the mobile banking apps we use every day. Let’s look at how it’s making an impact.

Banks are using AI to detect fraud in real-time. From identifying unusual spending patterns to blocking suspicious logins, AI models are trained on vast datasets to flag anomalies instantly. Global leaders like JPMorgan Chase and HSBC use machine learning to reduce false positives and act faster, protecting both the customer and the bank.

AI chatbots are transforming customer service. A great example is Ceba, Commonwealth Bank of Australia’s virtual assistant. Since its launch, Ceba has handled millions of customer requests, helping users with tasks like checking account balances, transferring funds, updating personal details, and even providing guidance on lost cards. The result? Shorter wait times, 24/7 support, and a smoother banking experience.

GenAI is stepping into the advisory space too. Robo-advisors are now using it to create personalized investment strategies. Instead of static portfolios, users get custom recommendations based on their financial goals and risk appetite. It’s efficient, scalable, and helps democratise wealth management services once limited to HNIs.

Voice commands are becoming the new touch. Banks like Capital One have integrated voice assistants (e.g., Alexa skills) to let users check balances, pay bills, or track spending, just by speaking. Voice-led journeys are especially helpful for accessibility and hands-free convenience. Early adopters report growing usage and high engagement.

Implementing AI in banking apps sounds like a win-win, faster decisions, smarter insights, better service. But like any powerful tool, it comes with its own set of challenges. Let’s take a closer look at a few key ones.

AI systems learn from data, and in banking, that data is incredibly sensitive. Ensuring that AI models don’t reinforce bias or unintentionally discriminate is critical. If users feel like decisions are being made unfairly or their data isn’t safe, trust takes a hit. That’s why ethical AI in banking and finance apps frameworks and clear communication about how user data is handled are must-haves. Transparency builds confidence, especially when customers are trusting the app with their money.

Most banking regulations demand clear reasoning behind decisions. But AI models, especially complex ones like deep learning, can sometimes feel like black boxes. If a loan is denied or a transaction is flagged, both the bank and the customer need to understand why. Tools like SHAP (SHapley Additive exPlanations) or LIME (Local Interpretable Model-Agnostic Explanations) help demystify model decisions, but banks still need human oversight to stay compliant and avoid reputational risks.

AI can be incredibly good at spotting suspicious activity, but it can also be too cautious. Flagging legitimate transactions as fraud can frustrate users and create friction. The challenge is finding that sweet spot between catching real threats and allowing normal activity. Improving model precision through better training data and regular model tuning can help reduce these false alarms and keep users happy.

AI brings great potential, but only when these challenges are tackled head-on.

AI in banking and finance can enhance user experience in banking apps by predicting user needs, like reminding users of upcoming payments or suggesting smarter saving habits. However, predictive features must be helpful, not invasive. Design teams should ensure that AI-driven insights appear timely, contextually relevant, and easy to act upon. Equally important is clarity in automated decisions, whether it’s a declined transaction or a credit score update, users should always understand why something happened, and what they can do next.

AI chatbots are often the first line of interaction in modern AI in banking and finance apps. But they can’t do everything. The transition from AI to a human agent must be quick, smooth, and frustration-free. A seamless handoff means the agent already knows the conversation context, so users don’t repeat themselves. Maintaining a consistent brand voice, whether through a bot or a human, is key. This includes tone, messaging style, and how information is presented. When done well, users feel supported, not shuffled.

Trust in AI begins with thoughtful interface design. Smart alerts that flag suspicious activity or nudges that guide users to save more money add value without overwhelming them. Visual cues should indicate when AI in banking and finance is being used, whether it’s through iconography or subtle copy like “Suggested by AI.” Users should always have the option to override or explore decisions. Transparency not only builds trust, it empowers users to stay in control of their financial lives while benefiting from AI’s speed and intelligence.

While data privacy, integration complexity, and compliance remain challenges, platforms like Dev Story offer pre-built frameworks and compliance-ready modules that speed up AI adoption.

Mobile banking app trends set to boost growth in the banking sector. Predictive AI already supports managing routine inquiries, saving a lot of time, analyzing their existing systems, and identifying process challenges. Let’s go deeper and see how the future trends in AI for banking apps can create experiences that meet their customers’ specific needs while efficiently scaling to growth.

Generative AI is reshaping digital banking. Beyond content generation, it’s now being used to create personalised financial summaries, automated customer communication, and even draft investment documents. Large Language Models (LLMs) are enabling these shifts, powering next-gen chatbots that not only answer queries but also offer financial planning, explain loan terms, or guide users through complex transactions in natural, conversational language.

Banking is moving from apps to ambient experiences. With AI in banking and finance integrating into IoT, wearables, and voice assistants, users might soon approve payments through a smartwatch or receive loan eligibility updates while browsing property apps. Contextual banking, where the app anticipates needs based on location, activity, or behaviour, means less friction and more intuitive support. For example, if your travel itinerary includes a foreign country, the app might proactively suggest currency exchange or spending limits.

As AI becomes central to financial decisions, global regulators are stepping in. From the EU’s AI Act to India’s proposed Digital India Bill, there’s growing pressure to ensure fairness, explainability, and auditability. Future-ready AI in banking mobile apps will need embedded compliance checks, transparency logs, and frameworks to document model decisions. This not only satisfies regulators but builds user confidence.

AI in banking apps is evolving beyond assistance toward autonomous financial operations. Future systems will automatically detect operational inefficiencies, predict system failures, and self-correct issues without human intervention. From reconciling transactions and adjusting credit exposure to auto-resolving failed payments, AI-driven self-healing systems will reduce downtime and operational costs. These models continuously learn from transaction flows, fraud attempts, and infrastructure performance. For banks, this means higher resilience and lower manual overhead; for users, it ensures uninterrupted, reliable services. Autonomous AI will become a silent backbone, optimizing operations while maintaining regulatory guardrails.

Future banking apps will move from feature-based personalization to journey-based intelligence. AI will map each user’s financial lifecycle—income patterns, goals, risk appetite, and spending behavior—to deliver dynamic, real-time financial guidance. Instead of static dashboards, users will receive adaptive nudges like optimized saving plans, credit improvement strategies, or investment rebalancing suggestions. These journeys evolve continuously as user behavior changes, making banking more proactive and advisory-driven. By combining predictive analytics with behavioral AI, banks can deepen engagement, increase product adoption, and position themselves as long-term financial partners rather than transactional platforms.

In short, AI in banking is moving from reactive to proactive, from isolated functions to seamless ecosystems—while trust, transparency, and adaptability remain key.

As AI becomes central to mobile banking, partnering with the top banking app development company like Dev Story can help banks stay ahead, deliver better user experiences, and remain competitive in a rapidly evolving market.

AI in banking and finance is redefining how banks engage with customers, manage risks, and deliver services. From personalized financial advice to intelligent fraud detection, AI in banking mobile apps offer speed, convenience, and a new level of customer-centricity. Yet, with these benefits of AI in banking come real challenges, data privacy concerns, lack of explainability, false positives in risk detection, and the need for transparent, ethical AI.

Designing effective AI-driven banking experiences requires more than just smart algorithms. It demands empathy, trust-building, and a strong focus on human-centred design. Banks must ensure that users feel informed, supported, and in control, whether interacting with a chatbot or receiving a credit limit decision.

As generative AI, contextual interfaces, and edge computing reshape the future, regulatory frameworks are also evolving. Responsible AI development is no longer optional, it’s a competitive necessity. Forward-thinking financial institutions must strike a balance between innovation and integrity.

For banks exploring AI, the key is to start small. Pilot targeted AI use cases in banking, monitor outcomes, gather user feedback, and scale responsibly. When done right, AI isn’t just a tool, it’s a strategic enabler of smarter, safer, and more inclusive banking.

The future of banking is intelligent, but it must also remain human. And that journey starts with thoughtful, deliberate AI integration today.