The banking app development market is a rapidly expanding sector. The global mobile banking market was valued at USD 1.43 billion in 2024 and is expected to reach from USD 1.58 billion in 2025, growing to USD 3.66 billion by 2032 at a CAGR of 12.70% over the forecast period.

To build a high-performing banking app, organizations need clarity on their goals, target users, regulatory requirements, and long-term scalability plans. Equally important is choosing a development partner that understands the complexities of banking systems, prioritizes security and compliance, and has proven experience delivering transaction-heavy, user-centric applications. Another key trend shaping India’s mobile banking market is the growing adoption of Artificial Intelligence (AI) and chatbots. Banks and fintech companies are increasingly leveraging AI-driven solutions to enhance customer support while streamlining internal operations and improving overall efficiency.

Henceforth, mobile-first experiences shape the modern digital economy, businesses are moving fast to launch seamless, high-performance apps. Selecting the right development partner is now critical. Here’s our expert-curated list of the top 15 banking app development companies worldwide, recognized for innovation, dependability, and transforming bold app ideas into scalable, market-ready products.

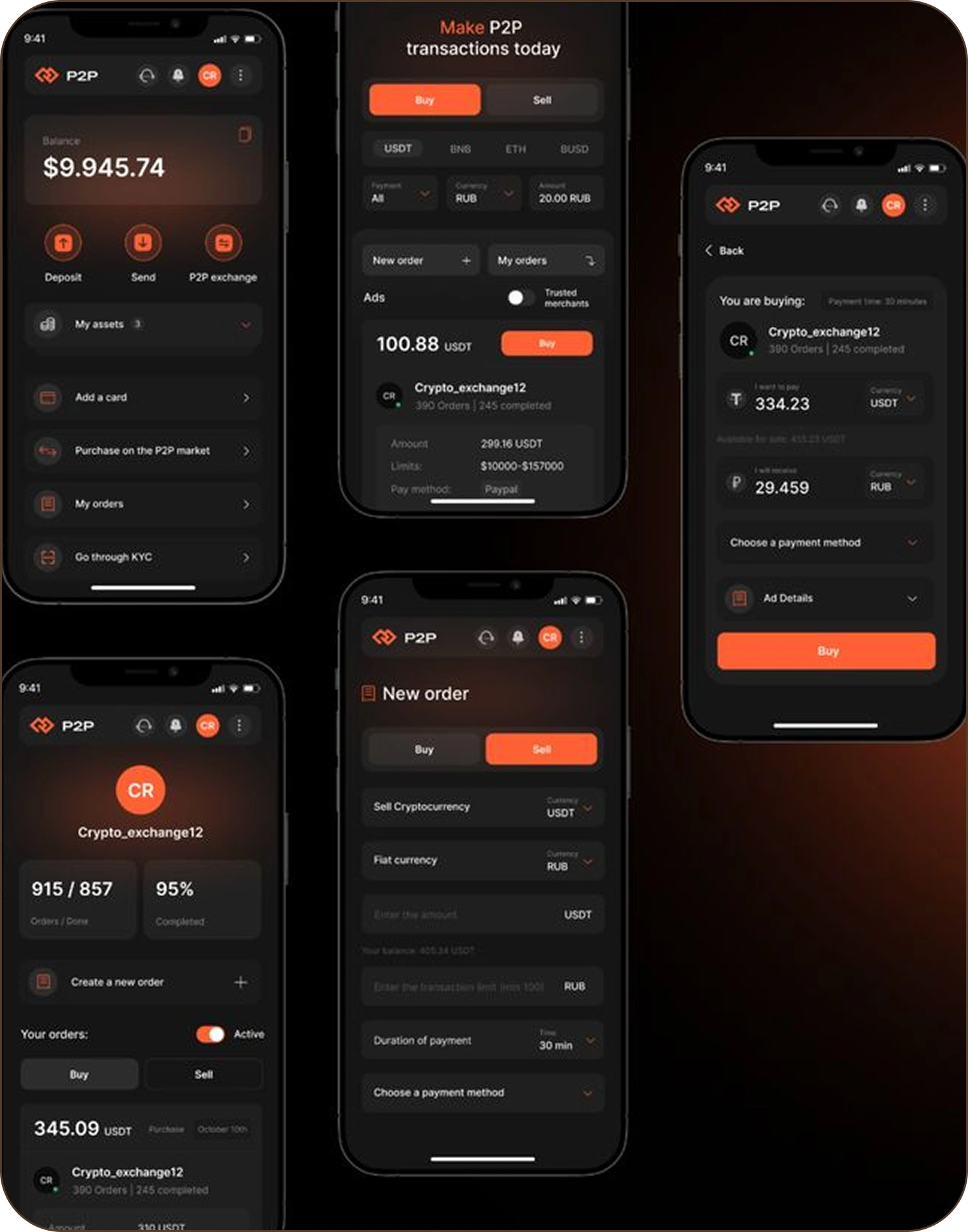

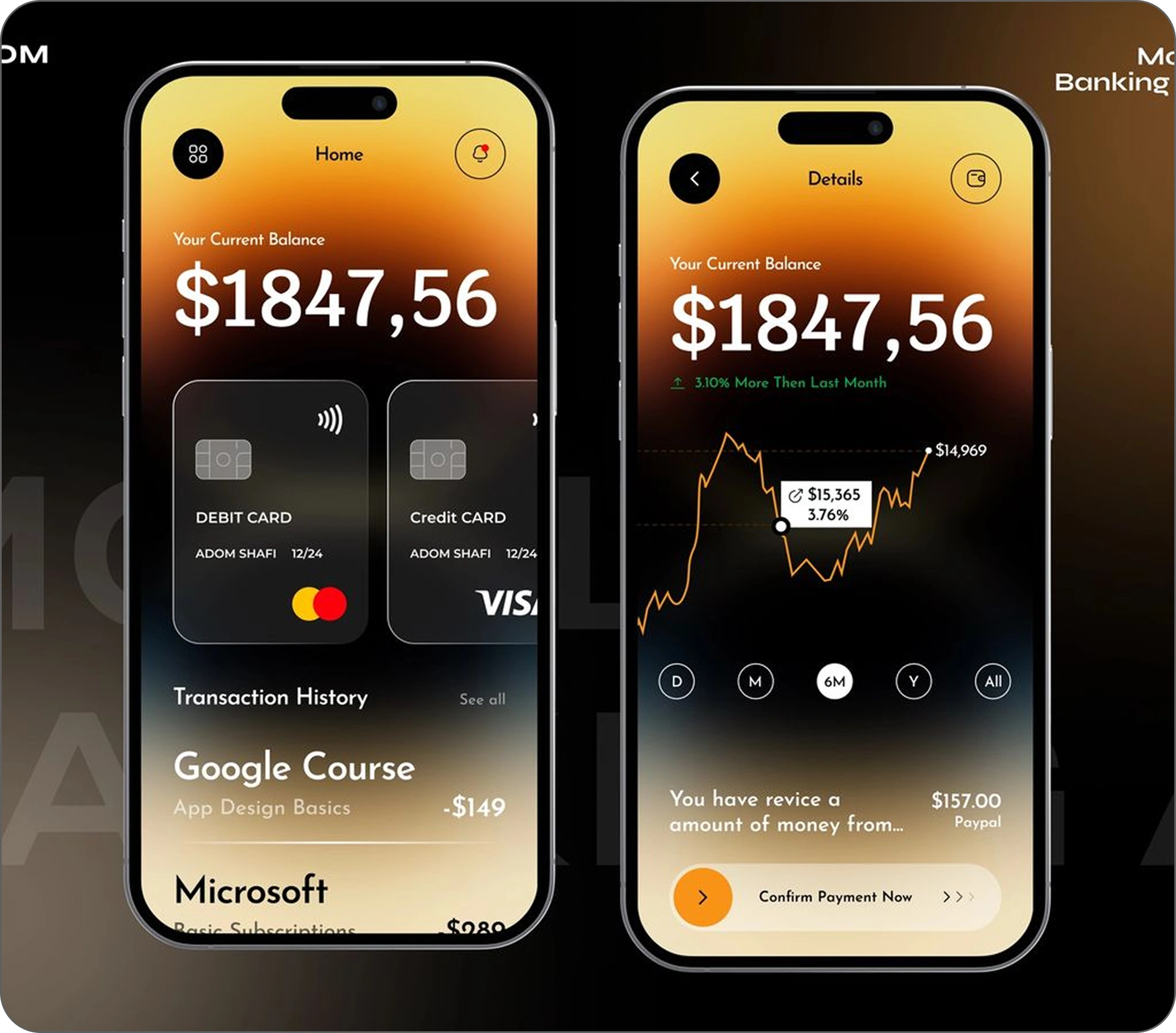

As digital banking continues to evolve, user expectations around speed, security, and personalization are higher than ever. Leading banking app development companies combine advanced technologies such as AI, blockchain, cloud computing, and data analytics to deliver compliant, resilient, and future-ready banking solutions. These firms support banks and fintechs across core banking, payments, lending, wealth management, and open banking, ensuring apps are secure, scalable, and aligned with global regulatory standards while enabling innovation and long-term growth.

Enjoy 20% Off All App & Web Services

Enjoy 20% Off All App & Web Services  Claim Your Offer Today -

Claim Your Offer Today -